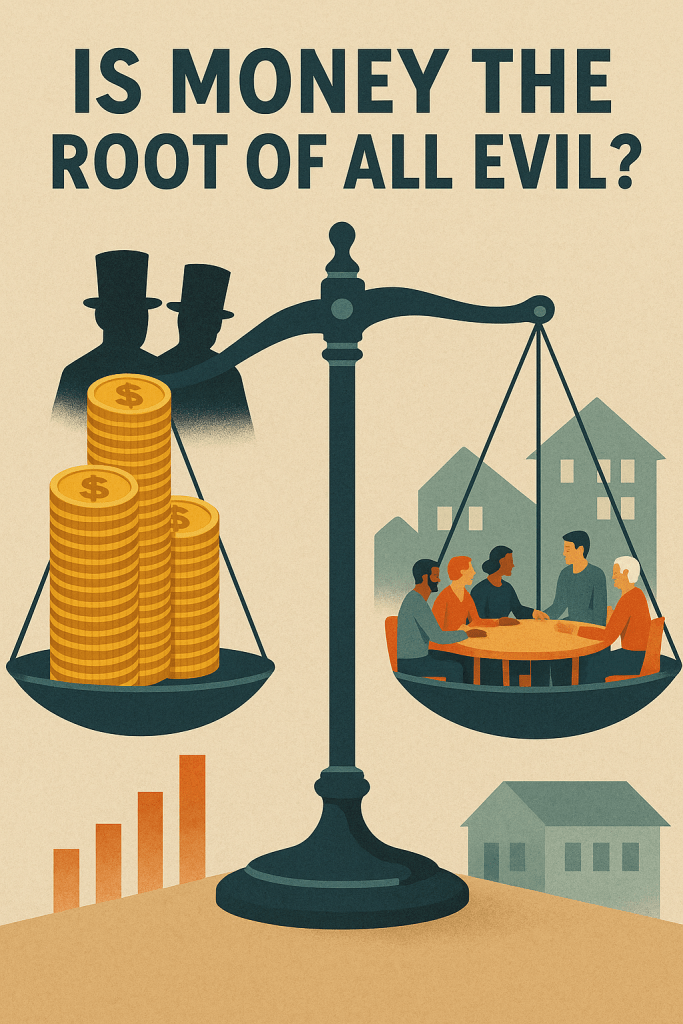

The phrase “money is the root of all evil” is often quoted to express frustration with how money seems to corrupt individuals and societies. Yet, this statement oversimplifies a much deeper issue. Money itself is not inherently evil; it is a neutral tool that facilitates exchange and cooperation in complex societies. The real problem lies in how money is controlled and used. When power over money is concentrated in the hands of a few banks, corporations, and political elites, it enables inequality, exploitation, and social harm. To understand whether money is truly the root of all evil, we must distinguish the tool from those who wield it unjustly.

Money as a Neutral Mechanism

At its core, money is a social agreement, a system of trust that enables people to trade goods, services, and labor without the need for direct bartering. It solves the “double coincidence of wants” problem: instead of needing to find someone who wants exactly what you have and has exactly what you want, money serves as a universally accepted claim on value.

Without money, growing economies and modern infrastructure would collapse into inefficiency. Money enables specialization, encourages innovation, and facilitates the coordination of the vast array of goods and services that modern societies require. In this way, money itself is neither good nor evil; it simply is.

The Concentration of Monetary Power

The problem arises when control over money, its creation, distribution, and rules, rests with a small elite. In today’s global economy, a handful of powerful financial institutions and wealthy individuals wield outsized influence over monetary systems. Central banks control interest rates and money supply, while private banks create money through lending. Large corporations and investors often decide where capital flows, prioritizing short-term profits over long-term social benefits.

This concentration of power distorts the purpose of money. Instead of facilitating fair exchange and prosperity, money becomes a tool for perpetuating inequality. Wealth accumulates at the top, while most people struggle with debt, wage stagnation, and economic insecurity. This disparity fuels social unrest, environmental degradation, and political corruption. The “evil” attributed to money is better understood as the result of unequal access and control.

Demonizing Money vs. Reforming Its Use

Blaming money itself for societal ills risks misunderstanding the underlying causes of these issues. Rejecting money outright is impractical; societies depend on it to function. The challenge is not money but its governance.

Reforms such as public banking offer ways to democratize monetary control. Public banks, owned by governments or communities, prioritize local investment in affordable housing, small businesses, and public infrastructure rather than speculative financial markets. When money creation is more transparent and accountable, it can serve the common good rather than private interests.

Likewise, progressive taxation and closing corporate loopholes can redistribute wealth more fairly. Taxing capital gains, estates, and financial transactions ensures that those who benefit most from the system contribute proportionally to the costs. These funds can support social programs, reduce poverty, and promote economic stability.

Money, Morality, and Human Values

Money’s role in society is deeply intertwined with cultural values. When success is measured by wealth accumulation and consumption, it fosters competition, greed, and materialism. This culture magnifies the harmful effects of monetary inequality.

Conversely, valuing community, cooperation, and mutual aid can temper money’s negative influence. Societies that prioritize social bonds over individual wealth tend to have stronger safety nets and more equitable distribution of resources. Recognizing the limitations of money as a measure of worth opens the door to alternative economies, such as cooperatives, barter systems, and time banks, that prioritize human well-being.

Real-World Consequences

The harsh reality is that in many wealthy nations, people still die from a lack of basic needs because money dictates access. Without insurance or income, individuals can’t afford healthcare, food, or housing. The United States, for example, has some of the highest healthcare costs in the world, leaving millions vulnerable despite enormous national wealth.

Hospitals, insurers, and landlords often justify their actions by citing the necessity of profits. Yet, when profit drives decisions on life-saving medication pricing or eviction policies, human dignity suffers. This systemic prioritization of money over people reveals why money feels like the root of evil to many.

A Path Forward

Addressing money’s darker side requires systemic change:

- Democratize Monetary Control: Expand public banking and transparent monetary policies that prioritize the public good over private profit.

- Progressive Taxation: Ensure that the wealthiest individuals and corporations pay a fair share to fund social services and infrastructure.

- Cultural Shift: Promote values that emphasize community, cooperation, and shared prosperity rather than individual accumulation.

- Build Alternative Economies: Support cooperatives, mutual aid networks, and local currencies that reduce reliance on traditional money systems.

These steps do not eliminate money but reclaim it as a tool for human flourishing rather than exclusion.

Conclusion

Money itself is not the root of all evil. It is a vital, neutral instrument that enables complex societies to function. The real source of harm is how money is controlled and used when concentrated in the hands of a few; it fuels inequality, exploitation, and social injustice. By democratizing monetary systems, reforming taxation, and fostering cultures that value community over accumulation, we can redirect money to serve all people fairly. Only then can we move beyond the destructive patterns that make money feel like the root of all evil and instead harness its power for collective well-being.

Leave a comment